With a view to remove the tax disparity between debt mutual funds and other fixed income instruments like FDs, the government has finally approved the amendments in the Finance Bill 2023. Till now, debt mutual funds held for 3 years or more enjoyed the indexation benefit on purchase cost and long-term capital gain taxation at 20 per cent on redemption. This made them attractive for investors in the highest tax bracket compared to FDs.

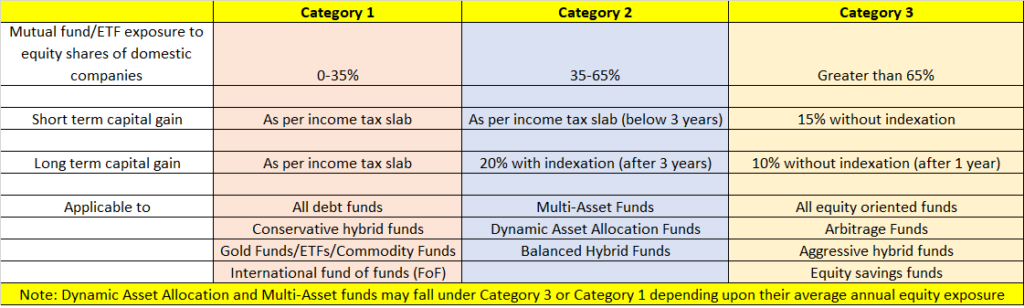

This tax arbitrage which debt funds enjoyed will be gone now. The bill states that capital gains arising from transfer/redemption/maturity of any specified fund will be treated as short term capital gains and taxable at applicable slab rates. Here specified mutual fund refer to any mutual fund scheme where the investment in domestic equity shares is less than or equal to 35 per cent of its corpus. So broadly now mutual funds can be classified into 3 categories from tax point of view. Refer to the table below:

This new provision in the finance bill under section 50AA will be applicable to new investments made in debt funds from April 1, 2023 and taxed as per the same from assessment year 2024-25. Existing debt funds or investments made till 31 March 2023 will not be affected by this change.

Should investors avoid debt funds and switch to FDs?

Now that there will be a level-playing field in terms of returns being similar, let us look at other aspects of comparison first.

- Deferred taxation: This is one of the biggest advantages of a debt mutual fund. You can defer tax and pay it only on redemption of funds. In the case of FDs, tax is deducted at source on accrual basis even though you have not received the income.

- Flexibility: While both FDs and debt funds are liquid, the former offer the flexibility of partial redemptions. You can redeem debt fund units to the extent of money required. There is no exit load after a certain period of investment. In the case of FDs, you need to break the entire FD when you need money and premature withdrawal comes at the cost of penalty. Even during times of market downturns, when equity bucket in total portfolio is to be enhanced, debt funds offer flexibility to switch investments to equity funds.

- Set off & carry forward: Capital gain or loss on debt mutual fund can be set off against other assets depending upon whether it is short term of long-term gain or loss. On FDs, you need to pay full tax on interest income as it is classified as income from other sources.

- Risk: Both FDs and debt funds carry different risks at varying levels. They carry interest rate risk and reinvestment risk, as evident from the meagre returns of 4-5 per cent earned due to falling interest rates in 2021 & 2022. Returns of debt funds are market-linked and not guaranteed. Further, banks in present times are not completely safe. Bank FDs offer a guarantee of up to Rs.5 lakh only in the event of bankruptcy or closing down. Debt mutual funds also carry credit risk as companies taking money from debt funds can default on interest and principal payments. The credit risk is spread out though as debt funds invest in a number of corporate papers.

Considering the above aspects, debt funds are a favorable investment option even though the tax arbitrage vis-à-vis FDs is gone. Debt funds also have the scope of offering higher returns during the turn of an interest rate cycle after rates peak out. But of course, this comes with higher risk and the timing is not easy to predict. It is here that a professional and competent investment adviser can guide to choose from different categories of debt funds taking into account your time horizon of investment and risk appetite. Moreover, be it FD or debt fund, an adviser can guide you how and when both can fit into your overall portfolio considering your goals, suitability and comfort level.