The key highlight of the Union Budget 2025-26 is obviously the tax bonanza doled out by the finance minister for middle class tax payers. There will be no tax on income upto Rs.12 lakh under the new tax regime. This however does not mean that the basic exemption limit has been raised to Rs.12 lakh. The tax relief is due to the cumulative effect of the:

- increase in basic exemption limit (from Rs.3 lakh earlier to Rs.4 lakh)

- revised tax slab rates and

- rebate under section 87A which has been hiked from Rs.25,000 earlier to Rs.60,000.

Only individual resident tax payers will be eligible for the rebate under section 87A. Let us see how income up to Rs.12 lakh will become tax free for FY 2025-26. Note that this is taxable income adjusted for standard deduction of Rs.75,000 under the new tax regime. So, the gross total income here is Rs.12.75 lakh p.a.

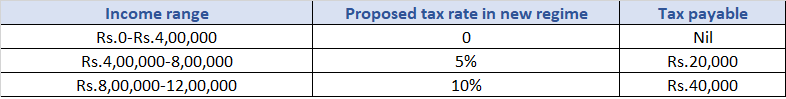

It can be observed from the table above that income upto Rs.4 lakh is nil. The proposed tax rate for incomes between Rs.4 lakh-Rs.8 lakh and Rs.8 lakh-Rs.12 lakh are 5 per cent and 10 per cent, respectively. This brings the total tax liability to Rs.60,000 for taxable income upto Rs.12 lakh. The proposed rebate of Rs.60,000 under section 87A will kick in here as taxable income is upto Rs.12 lakh. So, there will be no tax payable upto Rs.12 lakh.

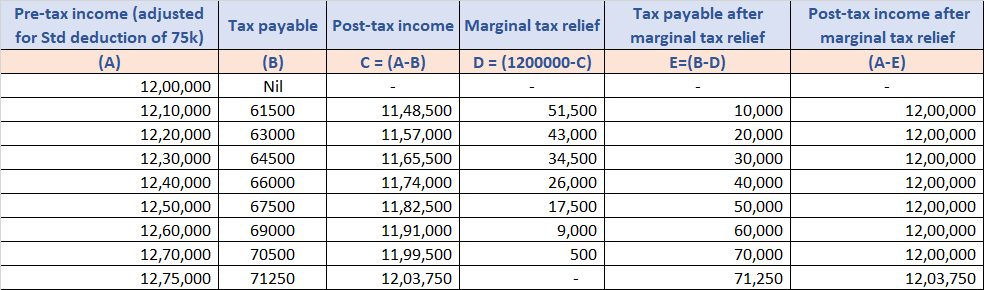

Now, what if your taxable income exceeds this threshold marginally, say, if you earn Rs.12.10 lakh or Rs.12.5 lakh? Some marginal relief will be provided here so that tax payers are not unfairly taxed, but it is not limitless. Let us see how the marginal relief applies on different income levels above Rs.12 lakh and till what limit.

As can be inferred from the table, tax payable gradually increases as your marginal tax relief reduces with rise in income. At Rs.12.75 lakh taxable income, your tax liability will stand at Rs.71,250.