The Nifty 50 is down 13 per cent from its 52-week high as on this date. Investors, especially, the post-covid entrants in the stock market who were used to seeing green in their portfolios have now become jittery. Market dips have become frequent and persistent and is hurting investors more. Besides external factors, valuations are seeing course correction. Patience of investors is wearing out as they see all gloom and doom across media channels and papers. This recency bias creates a behavioral challenge wherein, investors are likely to take extreme steps and make mistakes in desperation. One of them and a very expensive one is stopping SIPs.

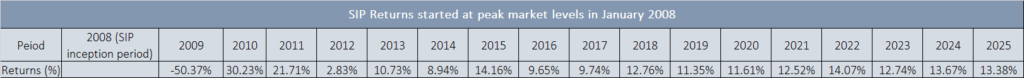

Let me take you back to 2008 where markets had seen one of the worst corrections, down nearly 60 per cent from its peak in January. This was caused due to the Global Liquidity Crisis in USA. This correction played out over 14 months with markets hitting a bottom in March 2009. Now, suppose you started a SIP of Rs.10,000 in Nifty 50 at this peak level in January 2008. This table illustrates how your SIP returns have panned out till date.

As observed from the table, your SIP returns in year 1, i.e., 2009 in Nifty 50 were a negative 50 per cent. This dispels the common notion that SIP returns are loss proof. If you continued your SIP in 2010 and 2011, the average annualized returns were positive & in double-digits. Most of them were nearly wiped off in 2012 and then average returns were in the range of at least 9-10 per cent p.a over the next decade. SIP in Nifty 50 of Rs.10,000 started from a peak of 2008 continued till January 2025 shows an average 13 per cent returns, beating inflation. These returns were achievable because you consistently stayed put and continued your SIPs.

In the present scenario too, you should continue your SIPs to avail of the buying opportunity at lower levels in falling markets. Because, you did not stop your SIPs when markets turned expensive and scaled new highs in the past few years. SIPs eliminate the futile effort of timing the market, help ride out the volatility and average out the investment cost.

Ironically, SIP appears to be the simplest mode of investing money and inculcating the discipline, but it is not. Staying invested, continuing SIPs over extended duration of time is the most underrated thing in mutual fund investing. Hence, there is always a difference between fund returns and investor returns. It all boils down to how emotionally resilient an investor are you to embrace both the bull and bear phases of the stock market.