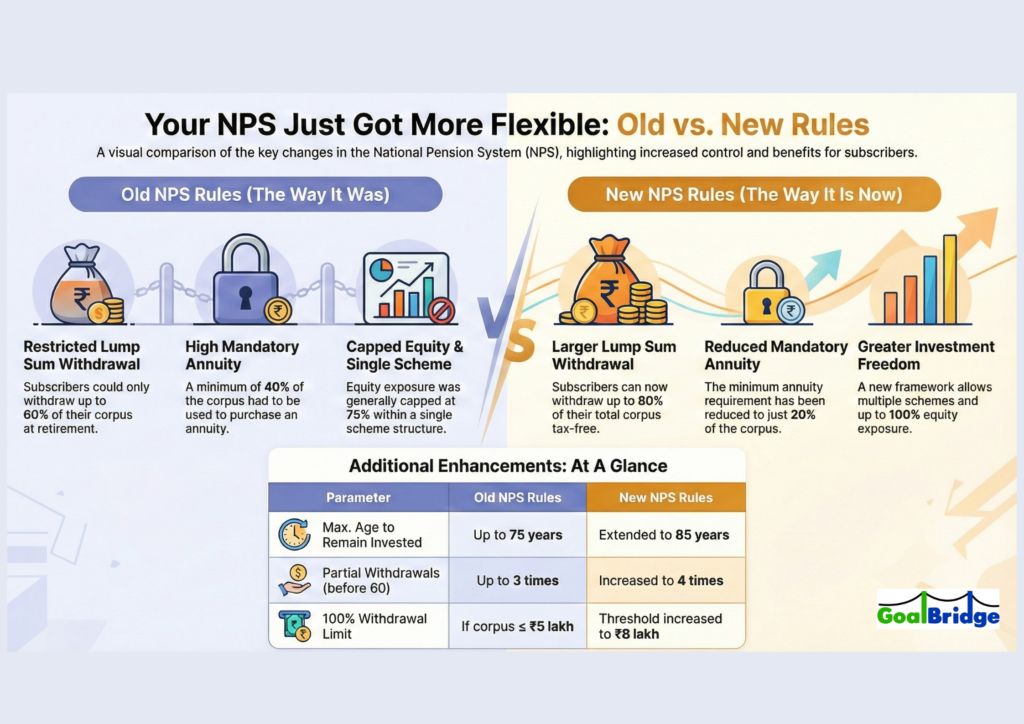

The latest revisions to India’s National Pension System (NPS) have allowed it to evolve into a flexible, low-cost, multi-choice, tax-efficient, long-term retirement product.

For many investors, this could well be a game changer.

Especially for those who:

- are relatively new to equity markets,

- have not experienced sharp market corrections or multiple cycles,

- lack the discipline to invest regularly,

- are constantly in a conundrum about market timing,

- repeatedly tinker with their portfolios, or

- are forever chasing rainbows – winners/trending products.

This behavioural gap is blatantly reflected in the difference between mutual fund scheme returns and actual investor returns.

One of NPS’s most underrated strengths is its minimum vesting period of 15 years. This is not a limitation, it is a feature.

It curbs emotional and impulsive decisions, enforces patience, and allows capital to compound uninterrupted over the long term. In doing so, it naturally tips the scales in favour of the investor.

In many ways, NPS mirrors how the earlier generation built wealth through EPF. Contributions were deducted automatically, rarely questioned, allowed to compound for decades, and eventually snowballed into a sizeable retirement corpus, often without the investor even realising the power of time and discipline at work.

Contrast this with how mutual funds are typically approached. Investing is often haphazard, driven by short-term performance or noise, and redemption is frictionless. Most investors lack true goal-based planning, which is precisely what is required to stay invested across market cycles.

With NPS, the framing itself is different. Investors are consciously aware that the money is earmarked exclusively for retirement and cannot be accessed prematurely. This mental accounting, combined with structural lock-in, fosters discipline – something that no amount of return chasing can replace.

Sometimes, the best investment outcomes come from just enough restriction to protect investors from themselves.