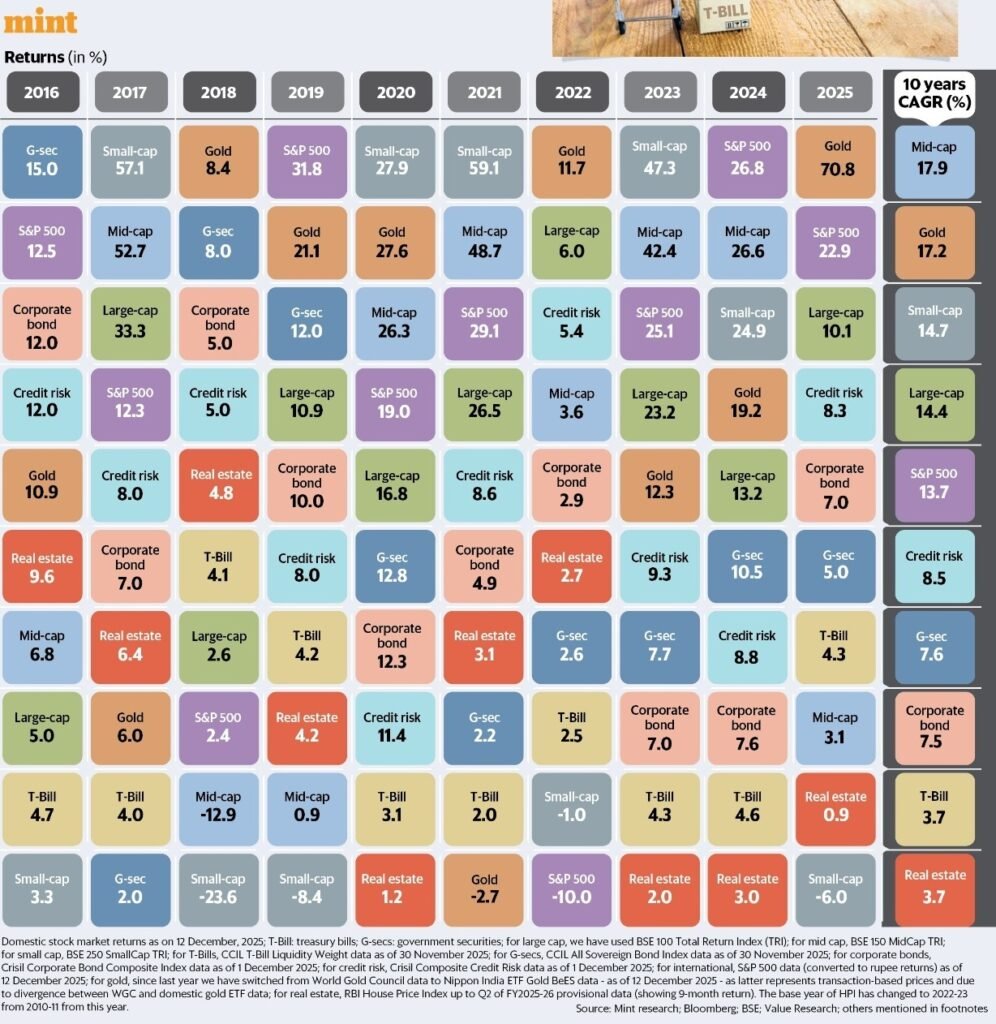

This table was published recently by popular newspaper Mint. Different investment options have been ranked in order of their return performance – from the highest to the lowest for each calendar year in the 10-year period – 2016 to 2025. They broadly fall under the following 4 asset classes – Fixed Income (debt), Equity, Gold and Real Estate.

Can you decipher any pattern in the returns of the asset classes above, from one year to the next? You will not be able to, because there isn’t any. Markets revert to the mean, reminding us that no country or asset class stays at the top forever. In fact, one year’s winner rarely becomes the next decade’s hero. The best-performing asset keeps changing, year after year.

The absence of any predictable pattern in this table underlines the importance of broad-based asset allocation in a portfolio. Asset allocation simply means distributing your money across different asset classes.

Predicting & chasing the best performing asset class every year is a losing game. Instead, it is prudent to devise an investment strategy anchored in asset allocation and financial planning. Such a strategy aligns your portfolio with your financial goals, time horizon, and risk appetite, rather than chasing winners and market timing. The weighted return of your portfolio will not be singularly influenced by any one asset class. Asset allocation enables to achieve optimum diversification, spread the risks and help competitively steer through all market cycles.

Remember, don’t chase past returns, don’t chase recent winners.

Asset allocation is the key – the secret sauce of smart investing!