The fundamental objective of buying a term insurance policy is financial protection of family members, the ones who are dependent on you – non-earning spouse, kids, senior citizen parents, etc. After age 60, life insurance is usually not required. This is true in most cases as adequate financial assets are accumulated for retirement, kids turn independent, kids may even support parents financially and loans are nil.

So ideally, it is prudent to have term insurance coverage till age 60, max 65 years.

But many people still consider buying term policy till age 80 or 85. The thought behind extending the term coverage is to leave something as legacy for family members. What is not considered is the cost impact of this decision. As the coverage extends with age, the life insurer is likely to bear higher risk. Hence the premium is higher at the time of buying the policy.

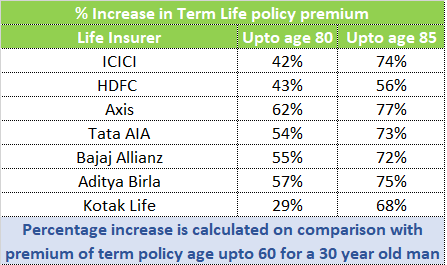

The table below highlights how much incremental premium you pay as a percentage on term policy from age 30 upto age 80 and 85 years compared to premium payable on term policy covered till 60.

As can be seen, you end up paying atleast 40-50 per cent more premium every year for policy term till 80 and atleast 60-70 per cent more for policy term till 85 years.

Think of term insurance as an ideal vehicle for protection, not legacy!