The Indian Parliament passed the Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Bill, 2025 earlier this December. One of the key highlights of the legislation is the increase in the foreign direct investment (FDI) limit in Indian insurance companies to 100 per cent. While this move is expected to boost capital inflows and support industry growth, the Bill fails to address one of the sector’s most persistent and critical challenges – customer grievances, including unfair business practices.

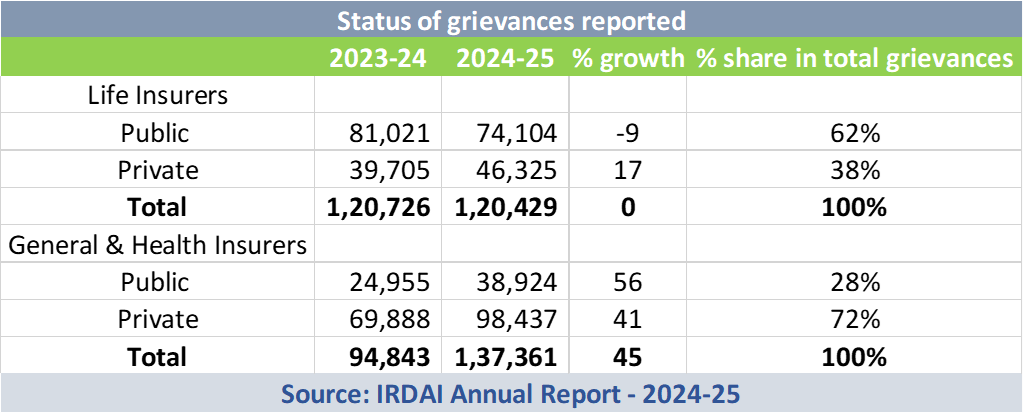

The gravity of this issue is evident from the latest data released by the Insurance Regulatory and Development Authority of India (IRDAI) in its Annual Report 2024–25, based on grievances reported on the Bima Bharosa portal.

Key observations from the report are as follows:

- The number of grievances reported under life insurance remained unchanged at around 1.2 lakh, compared to 2023–24, while grievances under health insurance rose sharply by 20 per cent.

- In the life insurance segment, 23 per cent of grievances were related to unfair business practices, up from 18.7 per cent in the previous year.

- Although the total number of grievances lodged against life insurers declined by nearly 9 per cent, they accounted for a dominant 62 per cent of total insurance grievances.

- In general and health insurance, as much as 69 per cent of the grievances were related to claims, marginally higher than the previous year.

- The total number of grievances against general and health insurers surged by 45 per cent, driven largely by a steep rise in complaints against both private and public insurers. Notably, private insurers accounted for 72 per cent of the total complaints in this segment.

These figures underscore a long-standing disconnect between regulatory reforms aimed at expanding the insurance market and the urgent need to strengthen consumer protection and grievance redressal mechanisms.