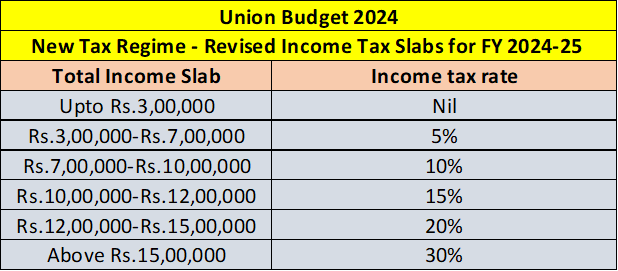

- Revised tax benefits under the new tax regime: With the aim of encouraging and incentivizing salaried tax payers to shift to the new tax regime, the tax slabs have been revised.

Further the standard deduction has been increased from Rs.50,000 to Rs.75,000 under the new tax regime. The tax rebate under section 87A also remains i.e., individuals do not have to pay tax if the taxable income does not exceed Rs.7 lakh in a year. The revised tax slabs coupled with the increase in standard deduction lead to incremental savings of around Rs.24,500 for the tax payer opting for the new tax regime.

It is to be noted that there are no changes in the old tax regime.

2. Definition of holding period of assets standardized: This is for the purpose of capital gains calculation. There will be only 2 holding periods for determining whether the capital gains is short term or long term – For all listed securities -12 months and for the rest – 24 months. This implies that the holding period for unlisted assets like bonds, debentures and gold which was earlier 36 months has been reduced to 24 months.

3. Short term capital gains tax hiked: This tax on shares, mutual funds, REITs, Invits has been increased from 15 per cent to 20 per cent.

4. Long term capital gains tax standardized: This tax for all financial and non-financial assets has been levelled at 12.5 per cent.

(a) In the case of equity shares and equity mutual funds, the long-term capital gains imply an increase from the earlier 10 per cent. However, to compensate the tax increase, the exemption on capital gains has been hiked to Rs.1.25 lakh every financial year from Rs.1 lakh earlier.

(b) In the case of gold ETFs, gold funds, overseas fund of funds, the long-term capital gains stand reduced to 12.5 per cent as against the applicable slab rate earlier.

5. Removal of indexation benefit on long term capital gains: While the long term capital gains tax has been levelled and reduced at 12.5 per cent, it also comes with the revocation of indexation benefits. This holds true across all assets – gold, property, debt funds, unlisted assets, etc. This specifically appears to be a major blow to property holders who have been holding old properties. Earlier, the long term capital gains were taxed at 20 per cent with indexation benefit. This now means that real estate owners selling their property will no longer be able to adjust their purchase price inflation. The indexation benefit however will be protected until 2001. This simply implies that gains till 2001 will be indexed and gains post 2001 will not be indexed. From case to case, the implication would depend upon sale proceeds from the property, holding period and capital gains earned.

6. Employer contribution to NPS limit increased: The maximum amount an employer can contribute to employee NPS has been hiked from 10 per cent to 14 per cent of the salary (Basic+DA) under the new tax regime.

7. Announcement of new NPS scheme for minors: The finance minister announced a new plan National Pension System – NPS Vaatsalya to facilitate parent’s contribution to their minor children’s NPS account. The account can be converted into a regular NPS plan once the children attain the age of majority (18 years).