I know people who have created huge wealth from humble incomes and disciplined savings. And, also those earning exceptionally well, yet constantly struggling financially due to poor cash-flow control and negligible investments. That is why, when I sit down to prepare a financial plan for a client, the one figure I pay very close attention to is Net Worth. It reveals far more than income ever can. It helps distinguish between those who are superficially rich and those who are genuinely on the path to long-term wealth creation.

Simply put, Net Worth is the difference between your Assets and Liabilities. But here I am referring specifically to Financial Net worth. So, this does not include assets like your self-occupied property, physical gold, vehicles, other high value belongings.

While we may own these assets, they do not generate income. In fact, they often come with loans, EMIs, maintenance, and running costs, making them closer to liabilities.

Instead, Financial Net Worth focuses only on income-generating financial assets – the ones which grow money for you even while you sleep.

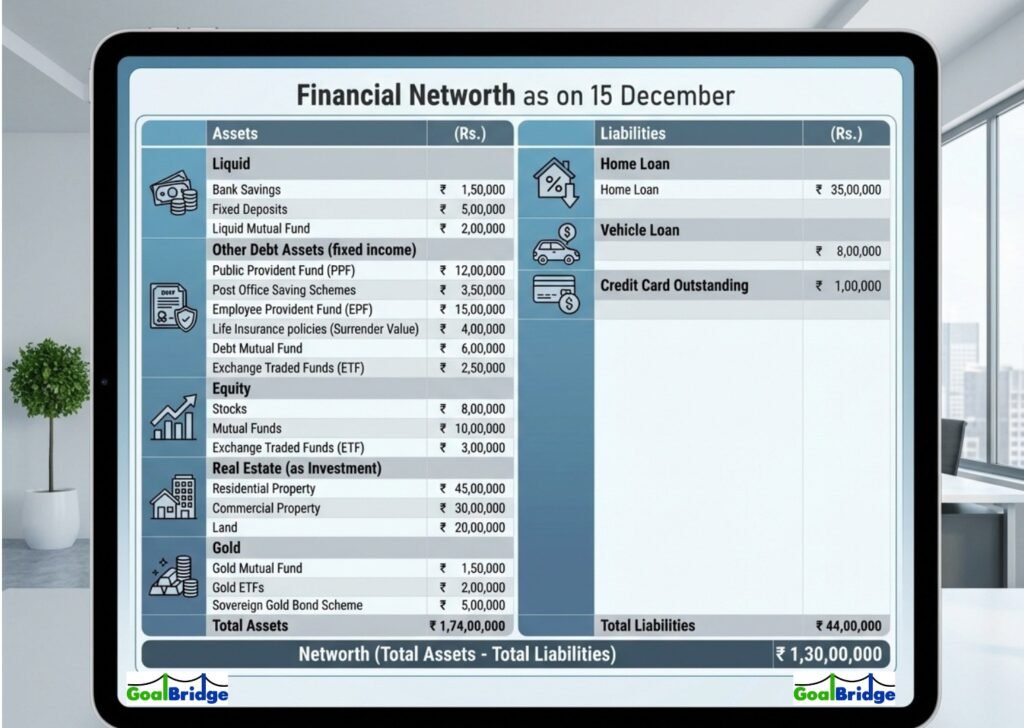

Here is a specimen of how your Financial Net worth Statement can look like:

If your assets outweigh your liabilities, you have a positive Net Worth. A negative Net Worth indicates excessive debt without sufficient assets to offset it.

Tracking your Net Worth

Net Worth is not just a static number – it becomes truly meaningful when tracked over time.

Reviewing it annually (or even half-yearly) helps you:

- Identify whether spending habits or loans are holding you back

- Measure real financial progress, beyond income growth

- Stay accountable to your financial decisions

The ultimate goal is simple: increase your Financial Net Worth every year.

Every financial decision you make should move the needle – either by

- Increasing your assets, or

- Reducing your liabilities

The key lies in cultivating a consistent habit of saving and investing, done regularly and with discipline.

As you watch your Financial Net Worth grow steadily over time, it brings a sense of confidence and accomplishment. More importantly, it encourages deeper thinking – about how much wealth you truly need to meet your goals and how to expand your horizons beyond money, without anxiety.

That’s what financial freedom is all about!

So, get started this New Year.

Wishing all my readers a happy and prosperous 2026!