Tata Capital is the latest company to join the list of IPO disappointments, causing enormous losses to investors who bought the company stock in the unlisted market at a hefty premium. The pre-IPO share price had peaked up to Rs.1,000-1,125 amid the frenzy in the unlisted equity space. The IPO price band announced between Rs.310-326 popped the pre-IPO bubble. The company eventually debuted on a weak note with a meager 1.3 per cent premium over the issue price.

The euphoria surrounding unlisted equities, continues unabated. This is primarily driven by FOMO and the greed to chase quick, abnormal and unrealistic returns. What investors fail to understand is the other side of the equation – the risks involved.

Cautionary part:

- Illiquid: Unlisted shares lack liquidity due to lack of public market. Finding a suitable buyer for a desired price can be challenging. Further, if the IPO gets delayed or cancelled, the unlisted holdings can fall sharply in value or become unsellable and the capital can remain locked for years.

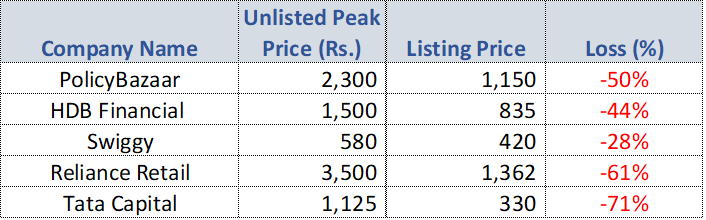

2. Hyped market price: Just before IPOs, grey market prices are often inflated by speculation. Prices are easy to manipulate because of limited supply. There is no guarantee that the price paid in the unlisted market would be higher than the IPO listing price. Refer to the graveyard cases in the table below:

3. Valuation challenge: Information on unlisted companies is less accessible compared to listed ones. This can make it challenging to assess the company’s management, operations and thereby decipher valuations effectively.

4. Mandatory lock-in of 6 months: Pre-IPO investors usually face a lock-in period post listing – often 6 months. They may be unable to sell if they wish to cash out in the event of the stock listing at a high premium.

5. Lack of regulation: Transactions in the unlisted equity space are off market deals, not overseen by SEBI or stock exchanges. Documentation and ownership transfer could have legal loopholes or may be delayed. There is no investor grievance redressal mechanism.

Not suitable for:

Unlisted shares are not suitable for all investors as they include high stakes. The potential losses can be huge which can hit the portfolio of small investors very hard.

Small retail investors who have:

- limited resources

- limited access to reliable information

- no risk appetite

- lack expertise to do due-diligence

- Do not understand asset allocation

- Need liquidity in the short/medium term

should ideally stay away from the listed market and invest in companies only through IPO or the secondary market.

Ignoring one’s own risk appetite and immediate liquidity requirements before betting high is a sure short recipe for a potential disaster.

As Warren Buffet popularly quotes – ‘Risk comes from not knowing what you are doing’.