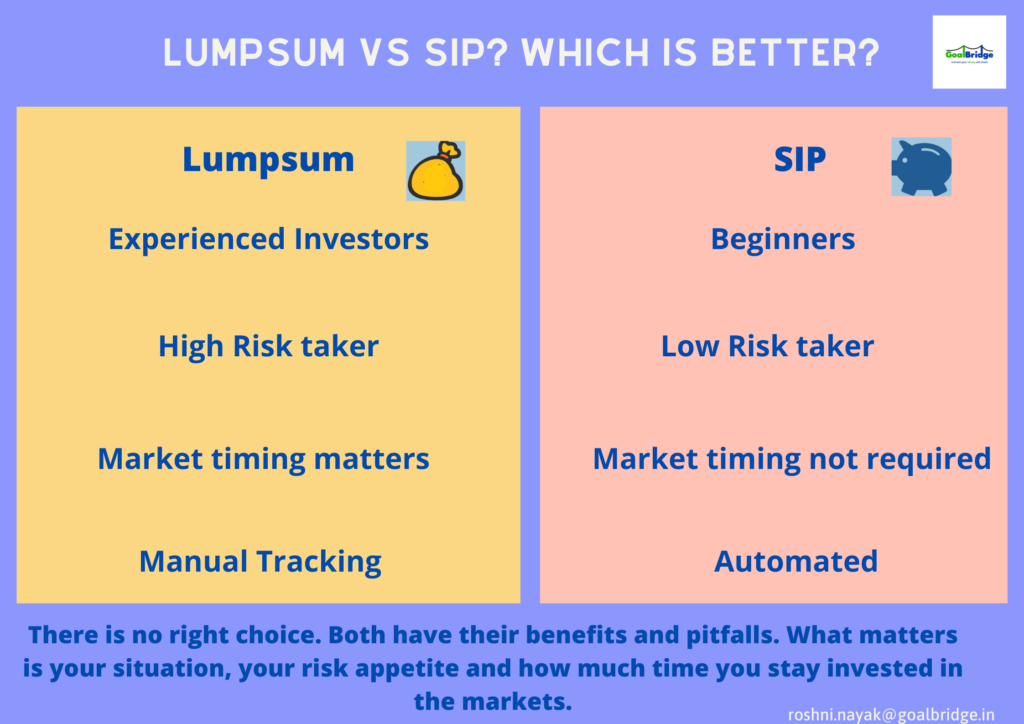

Consider this. Had you invested a lumpsum Rs.60,000 in Nifty 50 during the market downfall in March 2020, you would have earned a whooping 72% in exactly one year. And had you done a SIP of Rs.5,000 over 12 months, you would have earned 60%. But what if the markets had continued to tank further. I guess the numbers would eventually be in favor of SIP investing. So, what should you do – invest money lumpsum, in one shot or stagger it over a period of time in the stock markets? Check out the infographic to get over this dilemma.